Obamacare Subsidies- What Will Yours Be?

Subsidies…it’s a word looming around daily on the news, but not many Americans understand what it exactly means for them. According to a recent poll conducted by The Kaiser Family Foundation, 42% of Americans are unaware that the Affordable Care Act is an actual law. Of that 42 percent, 23% say they don’t know enough to say what the status of the law is.

In my opinion, that’s a problem…

So with this nice little blog post here, I’m going to do my best to educate you on what can be expected to happen to you and your family beginning January 1st, 2014.

Let’s Cover the Basics of the Affordable Care Act:

First and foremost, it is important to recognize that the Affordable Care Act is indeed a law, and will be fully implemented starting January 1, 2014. This means that Americans will now be required to purchase health insurance, or be penalized 1% of their income, or $95 per person (whichever is greater) for the first year. The penalization increases each year subsequently. This penalization will be reflected in your tax returns if you choose to not purchase health insurance that meet the essential health benefit requirements.

The government decided that in order for this to play out, the required health insurance coverage needs to be affordable (hence “Affordable” Care Act). So, they decided to attach subsidies to the premiums to those who have an income less than 400% of the poverty level. So the amount of subsidy you will receive is dependent upon your adjusted gross income from the prior year.

Now let’s be real. Most people do not know what 400% of the poverty level is and whether they fall within that percentage, and most people do not know off the top of their head what their adjusted gross income is… so I’m going to give you a few scenarios* to let you get a better grip on what this may look like for you and your family.

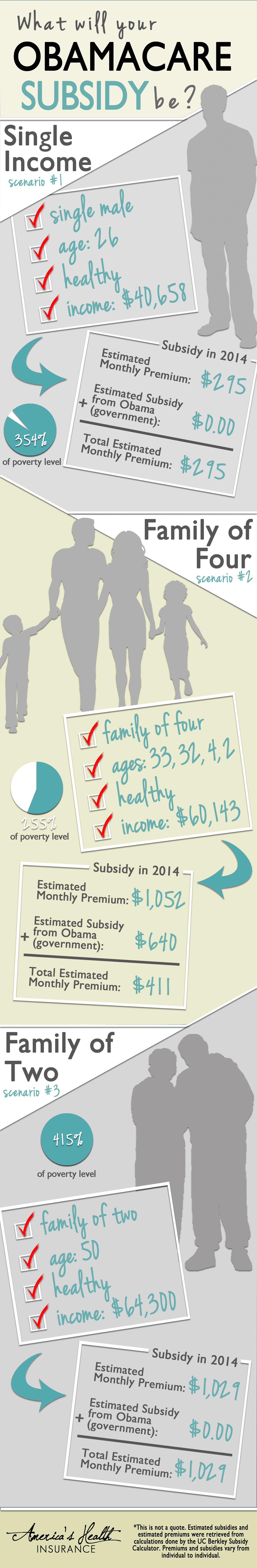

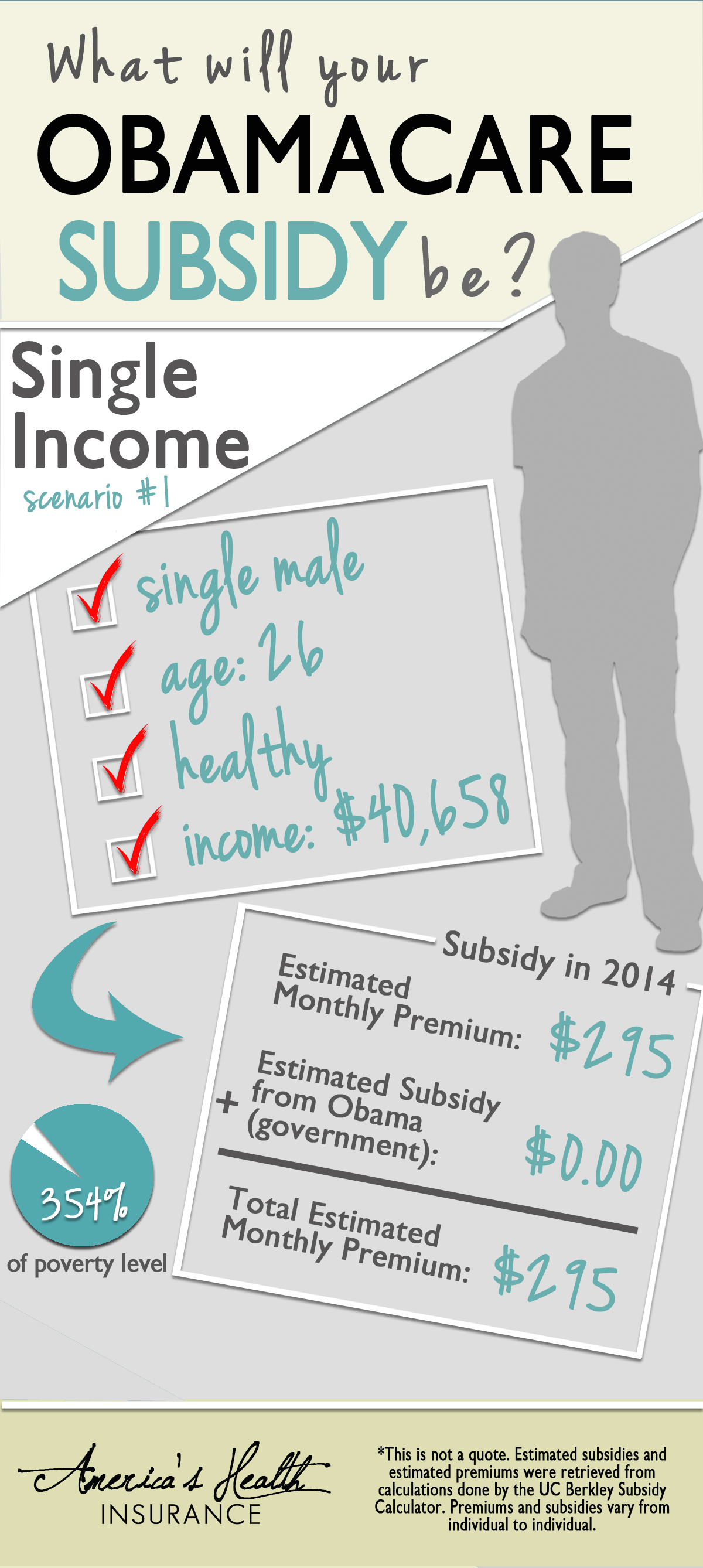

A One-Earner: 26 Year Old Male

According to the U.S. Department of Justice, the median income of a one-earner living in West Virginia is $40,658. Now lets just say that one-earner is a healthy male, he’s 26 years old, and he lives in Charleston, West Virginia. He does not have a spouse and he does not have children. According to the UC Berkley Labor Center Federal Subsidy Calculator, the HHS will bill this man an estimated monthly premium silver** plan of $295 with zero subsidy. Beginning in January 1, 2014- he will be required to pay this premium every month or be penalized.

Here’s an interesting fact. Today, this same man would be able to purchase a health insurance policy with similar benefits to the silver plan shown above ($2,500 deductible, 80/20 co-insurance, prescription coverage, mental health coverage, dental/vision coverage, rehabilitative care coverage, and 100% wellness) for a fraction of the cost. If this man was to purchase a similar plan today, it would cost him $198.77 per month. Quite a difference, eh?

Now if you’re a 26 year old male making roughly $40,000/year or higher, don’t freak out yet.

There’s a little known Obamacare Loophole out there that may save you some cash next year. You can read more about the loophole here and here. To sum it up, there are health insurance carriers offering a “rate-hold” that essentially accesses that loophole and allows you to maintain your premium rate throughout the 2014 year. In case for this man in the scenario above, it means that his health insurance rate would not have to increase to the $295 on January 1st, but rather he can keep the $198.77 premium rate through December 2014. This scenario could be the same for you, but you have to purchase this “rate-hold” health insurance plan before December 31, 2013, or otherwise you will miss out. By purchasing the “rate-hold” plan today, it would save this man a total of $1,154.76 in premium for the year of 2014.

I don’t know about you, but $1,154.76 can buy you a nice little vacation cruise, or a nice little golf set if you’re into that kind of thing. Whatever you spend it on, I’m sure you would rather spend it on that than a health insurance premium.

A Family of 4

Now onto our next scenario: a family of four. We have a family of four living in Columbia, South Carolina. The man of the house (age 33) makes a good living of $60,143, while his wife (age 32) stays at home with their two children (age 2 and age 4). According to the UC Berkley Labor Center Federal Subsidy Calculator, this family can expect on January 1st to have a monthly premium bill of around $1,052. But great news, this family will be receiving a governmental subsidy of around $640, bringing their final monthly balance to an estimated monthly premium of $411 for the entire family. They fall in 244% of poverty level.

This is an example of a family that will be benefiting from the Affordable Care Act.

Today, this same family would be paying a premium of $754.73/month for similar benefits. This family will definitely want to take advantage of the subsidies that the government is offering. By doing so, they will save $4,124.76 per year. (That’s a lot of family cruises).

However–location, location, location!

Today, a healthy family of four living in Baltimore, Maryland would have a premium of approximately $438.23 with similar benefits to the silver plan. Although they would be spending roughly $330/year more for an un-subsidized plan, they would have access to a larger network of doctors than what they could receive from a “metallicized” (Obamacare) plan in the exchange. Another not so well known fact about the plans being offered in the Affordable Care Act through the exchanges is the network is very restrictive, meaning it’s possible that you will be required to visit only certain doctors and certain hospitals. By paying the extra premium and purchasing a health insurance plan outside of the exchange , you will be able to keep your current network and current doctors.

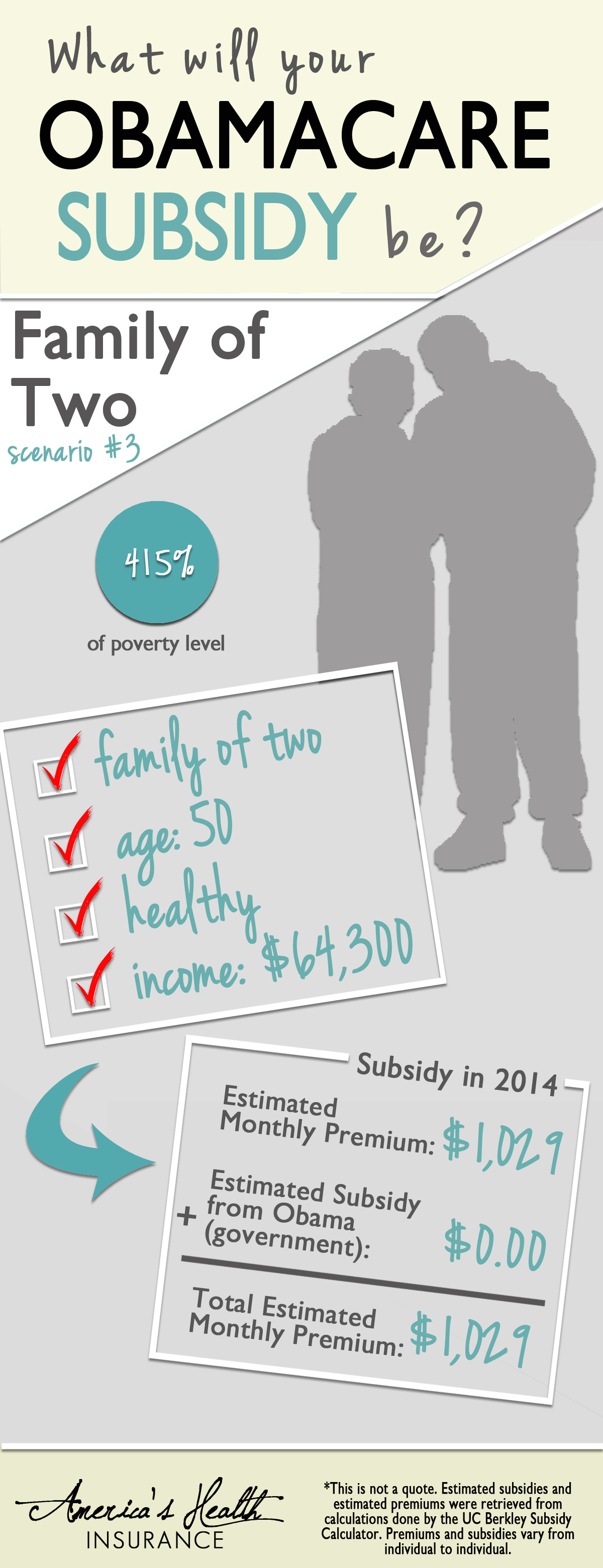

A Family of 2

The last scenario is a family of two. This family of two are both age 50, healthy, and living in Denver, Colorado. They are making a combined income of $64,300 (the median family income for two in the state of Colorado). According to the UC Berkley Labor Center Federal Subsidy Calculator, HHS will be billing them an estimated monthly premium of $1,029 with zero subsidy.

Today, this same family of two can have a health insurance policy with a “rate-hold” and similar benefits to the silver plan through 2014 for approximately $793.46 per month. By taking advantage of the Obamacare Loophole mentioned aboved, they could have a total savings of $2,826.48.

Take advantage of the “rate-hold” before it’s too late:

For most but not all, the rate-hold may be a significant way to help keep money in your pockets through the first year of Obamacare. To do so, it is essential to purchase a policy with an effective date before December 31, 2013. Most people that purchase a health insurance plan today, do not purchase plans with all the essential health benefits that Obamacare requires (which ultimately increases the rate of the premium). Many of the scenarios above can actually save even more money by not purchasing plans with similar “rich benefits” that are found in the Obamacare silver plans.

Whatever you decide to do, we are here to help. If the subsidized plans are the best option for you, you will be able to purchase governmental subsidized health insurance during the first open enrollment period (October 1, 2013 – February 28, 2014) through a federal exchange, or a state exchange (depending on what state you live in). If you are interested in purchasing a subsidized plan through the governmental exchange, give us a call. We do all the hard work on your behalf to make sure that you receive the best possible plan for your family. Also, we’re there through the life of your policy, so if you ever have a question about what is covered, which doctors are in your network, or whatever it may be, we’re just a phone call away. (It may be a little easier to get a hold of us, than the government. Just sayin’.)

*Please remember that each scenario may not fit you and your family exactly. Premiums are highly dependent upon location, health history, age, smoker/non-smoker, and income levels beginning January 1, 2014. With that said, it’s very unlikely that you will be able to receive a quote that fits the exact numbers listed in the scenarios above. Premiums will vary from individual to individual. Use this as a guide to better understand what premiums may look like for you, but do not view it as a quote.

**The following scenarios are based off an Affordable Care Act silver health insurance plan. An equivalent to that plan today would have a $2,500 deductible with an 80/20 co-insurance. It would have $500 deductible prescription card and would contain all the essential health benefit requirements such as, but not limited to: maternity, mental health coverage, rehabilitative services, laboratory services, preventative and wellness services, dental coverage, and vision coverage.

Leave a Reply